Deriving Iron Butterfly

Let’s talk about Short Straddle which gives us a range for where we can get our profit. Assuming, NIFTY 50 is at 9837.4 right now.

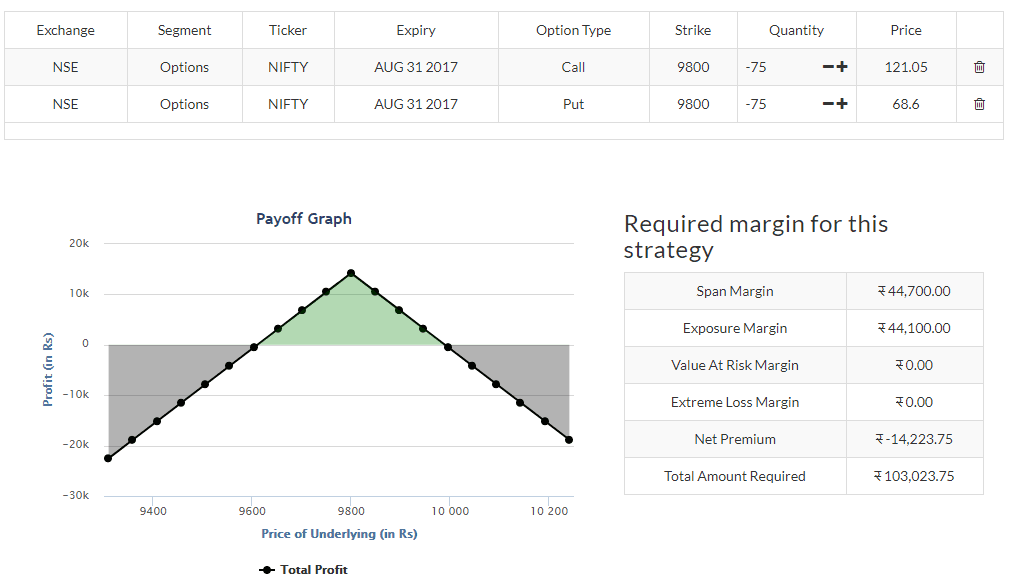

Here is our straddle of 9800 CE and 9800 PE.

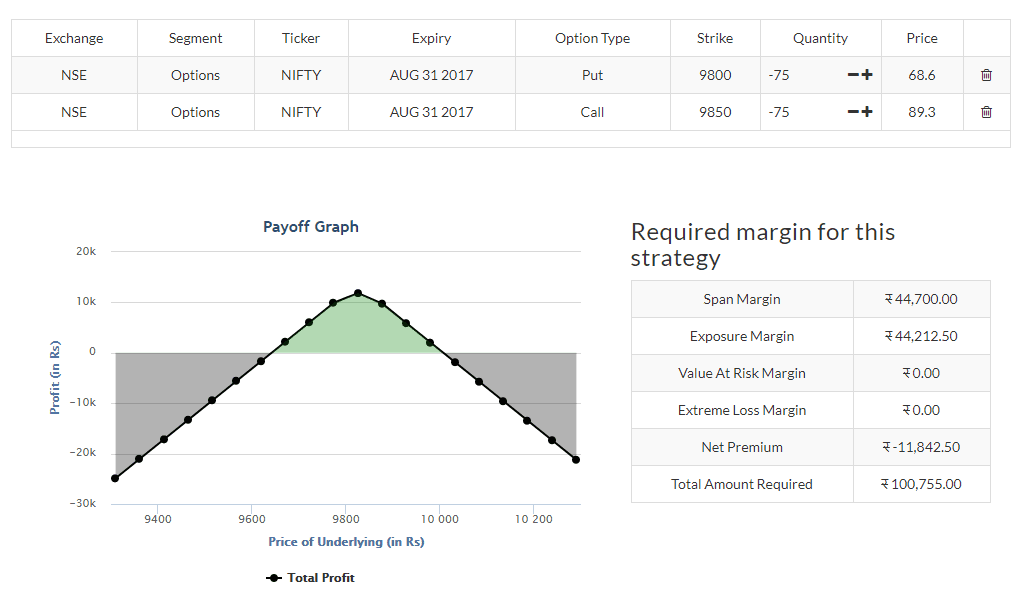

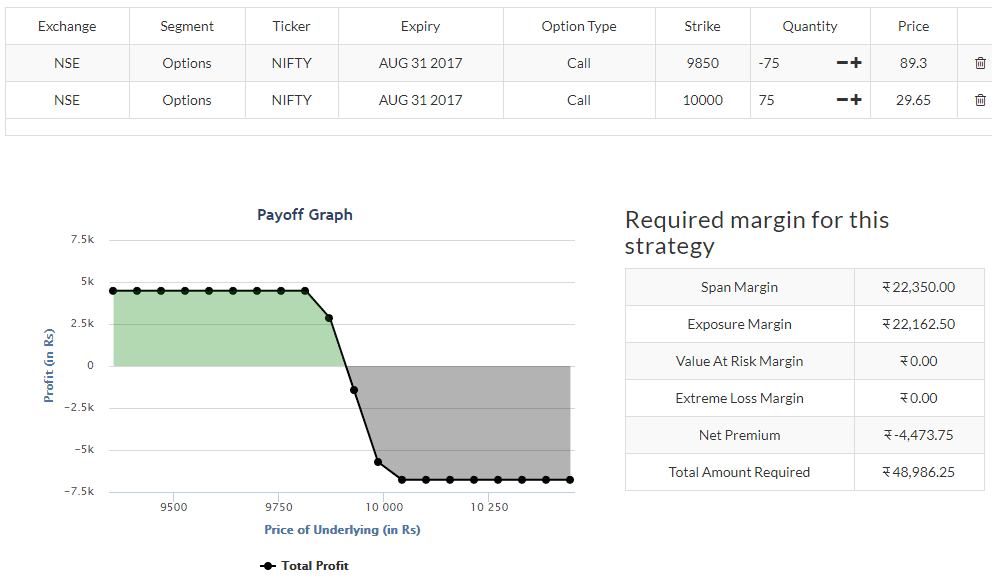

Here is a short strangle of 9800 PE and 9850 CE. But it is very close to our straddle’s work. It gives us a range where our profit lies.

But both have an unlimited downside! How can we convert them to limited loss? Let’s work separately –

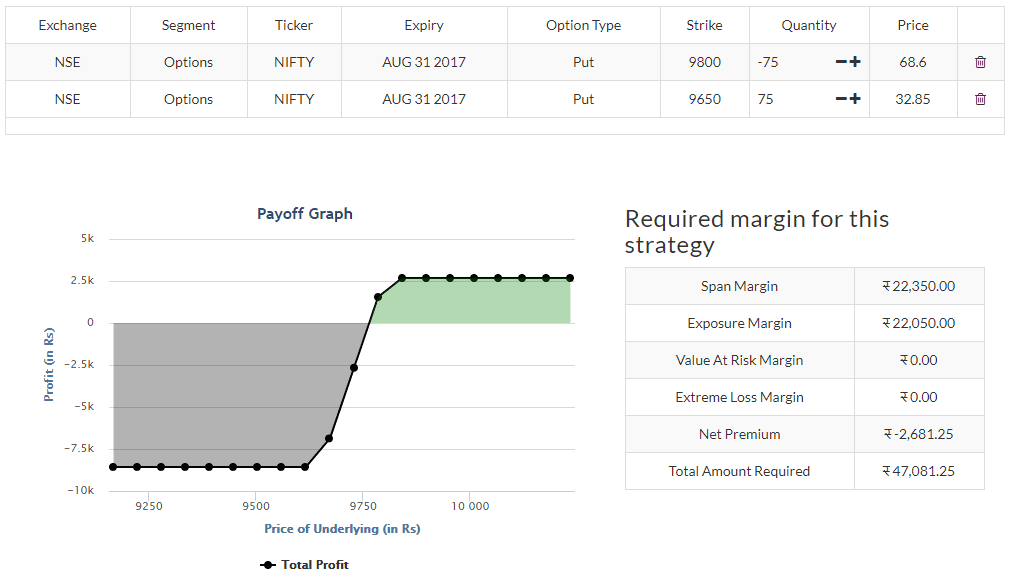

For 9800 PE we can just buy PE at the lower strike price (OTM). So buy 150 points away i.e. 9650 PE.

Well, it limited the unlimited loss part but we had to sacrifice a significant amount of profit for doing so too because the put option premium debited will be a loss if the trade moves into our direction (i.e upside as we are betting on 9800 PE sell).

What we did here is Sell OTM Put (closer to spot) – Buy OTM Put (away from the spot) which is also known as Short Put Vertical Spread!

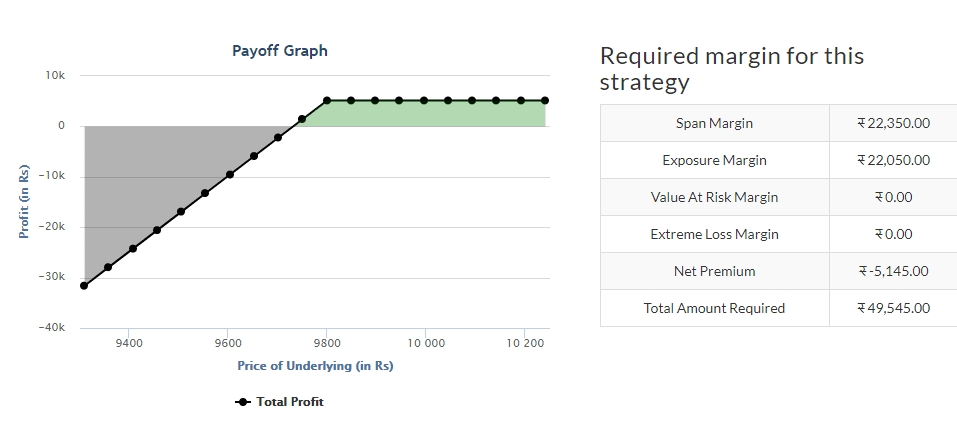

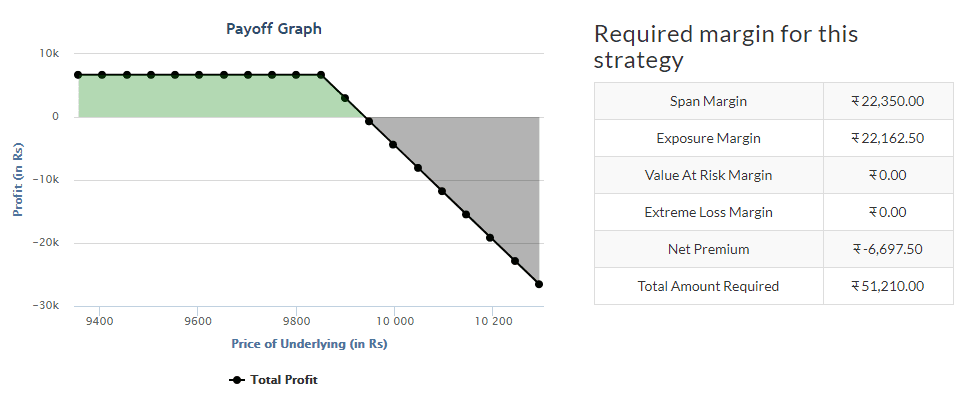

Similarly, let’s look at 9800 CE –

To limit unlimited loss; let’s buy a call option at a higher strike price which is at a lower premium as it is away above from the strike price. Let’s buy 150 points away i.e. 10000 CE

Well, it limited the unlimited loss part but we had to sacrifice a significant amount of profit for doing so too because the call option premium debited will be a loss if the trade moves into our direction (i.e downside as we are betting on 9850 CE sell).

What we did here is Sell OTM Call (closer to spot) – Buy OTM Call ( away from the spot) which is also known as Short call Vertical Spread!

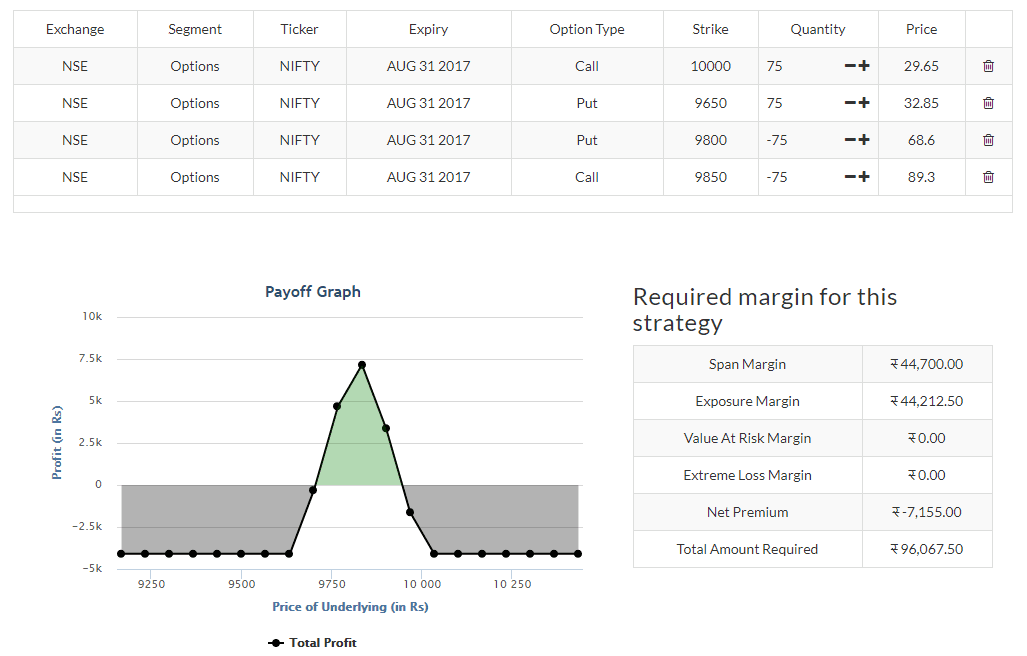

So combining Short put Vertical Spread and Short call Vertical Spread gives us our short straddle with limiting the unlimited loss part.

This is called Iron Butterfly.

Let’s combine both setups into one –

- Short OTM Put Vertical Spread

- Short OTM Call Vertical Spread

So, in this case –

- Short OTM Put Vertical Spread – Sell 9800 PE; Buy 9650 PE

- Short OTM Call Vertical Spread – Sell 9850 CE; Buy 10000 CE

Short Call Vertical Spread

So it has a range of profit as well as our loss is limited too.

Ideal Implied Volatility Environment: High

It’s a short-selling setup hedged towards both upside and downside but it is a net credit setup. So, the more IV, the more premium.

Max Profit:

- The maximum profit potential for an Iron Butterfly is the net credit received.

- The maximum profit is realized when the underlying settles between the short strikes of the trade at expiration.

Max Loss:

(Short Put Strike – Long Put Strike – Credit Received) Or, (Long Call Strike – Short Call Strike – Credit Received)

Max Loss Occurs When Price of Underlying >= Strike Price of Long Call or, Price of Underlying <= Strike Price of Long Put

How to Calculate Breakeven(s):

- Upside: Short Call Strike + Credit Received

- Downside: Short Put Strike – Credit Received