Long Calendar Spreads

A long Calendar Spread, which is also referred to as Time Spread or Horizontal Spread, is a trading strategy for derivatives is a direction neutral and low-risk strategy that profits from theta (i.e. profit increases with time) as well as from an increase in vega.

Direction Assumption: Neutral

Setup:

- Sell Call/Put options of near term expiry.

- Buy Call/Put options of long term expiry.

Ideal Implied Volatility Environment: Low

Notes on Selection of Strike Prices:

- ATM Strike prices have the most extrinsic value. So, they are the best selection for Theta.

- OTM Strike prices get more impact on rising IV (hence, vega) than ATM options.

Choice of Strike Price and Max Profit:

The maximum profit is very hard to calculate as we have options of different expiry cycles. So, We shall be discussing the cases of both legs separately.

The “Sell Near Term Expiry” Leg:

- Theta – The maximum profit happens if we select the ATM Strike price as We’re eating the Theta by selling this. The maximum profit happens if the market stays at the current point.

- Vega – Vega doesn’t impact Near Term options.

- Choice of Strike – The impact of Vega is lower in ATMs than OTM. So choosing the ATM strike price is sound!

The “Buy Long Term Expiry” Leg:

- Theta – As Theta follows a curve of exponent, it increases rapidly at the end and stays almost flat at beginning. So, the impact of Theta will be very less in this option until the expiry of the near term options.

- Vega – An increase in implied volatility, all other things held the same, would have a positive impact on this strategy because longer-term options are more sensitive to changes in volatility. So, there will be a rise in the premium as volatility spikes up.

- Choice of Strike – The choice of ATM options is again popular in this case as well as the intrinsic and extrinsic value is properly balanced.

The extrinsic value of Long Term options get positively impacted by Vega and negatively by Theta.

How to Calculate Breakeven(s):

- The break-even for a calendar spread cannot be calculated properly due to the different expiration cycles being used.

- Both of the options can have different implied volatility because we are talking about future volatility as well as the present volatility.

In cases of singular fundamental events, where the event had a small impact as per historical data- Like FM’s speech during the market time. The shorter expiry options may have more volatility than longer expiry ones till the uncertainty which is a caveat.

So, conceptually, there are two breakeven points, one above the strike price of the calendar spread and one below.

Long Call Calendar Spread

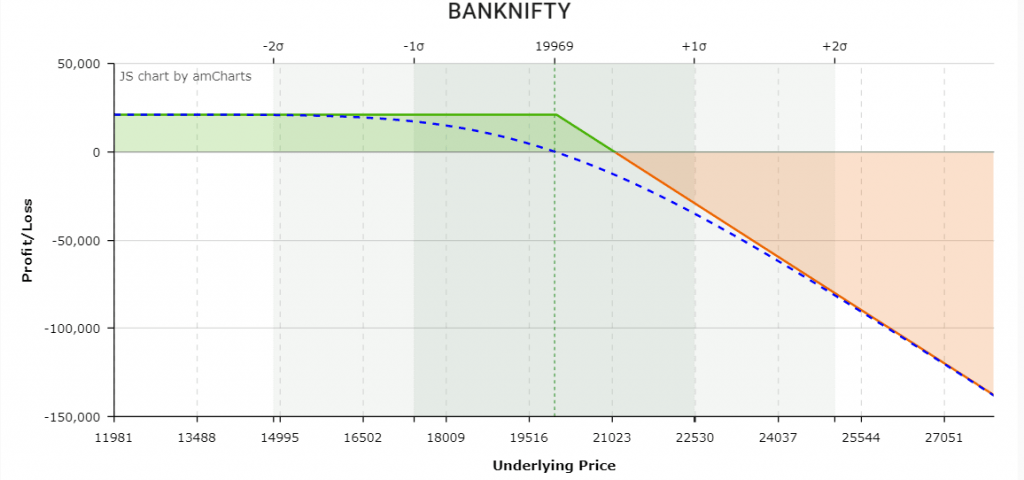

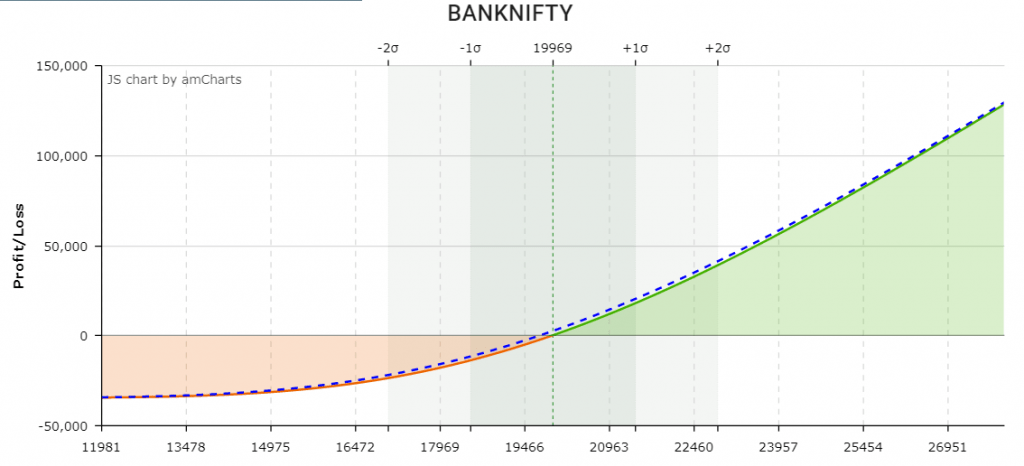

Here is an example of a payoff graph where –

- Sell BankNIFTY 1st Apr 20000CE at 1050

- Buy BankNIFTY 30th Apr 20000CE at 1729.35

In this image, the movement of the second leg is shown in the blue dotted line!

Directional Assumption: Neutral

Now, How do these break even points constructed?

We need to see both the legs differently in an assumption that the two options will not trade at the different implied volatility.

-1 x 01 Apr 20000CE

+1 x 30 Apr 20000CE

On the left side, We have the first leg’s break even on its expiry day. On the right side, We have the same for the second leg! Now the assumption here is there is no change of Implied Volatility! The more the implied volatility increases, the lower will be the breakeven of the second leg.

Max Loss

Although we can not calculate the maximum profit. The maximum loss in the case is easy to calculate. This is a debit spread!

- In the above trade, You are getting a premium from the first leg and giving a premium for the second leg.

- The second leg has a more premium as it has expiry in the far-term!

- So, You end up giving a premium which is the maximum loss.

This is why it is called “Long” Calendar Spread as We are giving premiums like we have to do for buying(read, “Long”) options.

In this case, the maximum loss will be (Premium of the second leg – Premium of the first leg) * Lot Size = (1729.35-1050) * 20 = 13587

But, the second leg can not goto 0 practically right on the expiry day of the first leg? So, The max loss will be quite lesser than this figure.

Long Put Calendar Spread

Note that, the construction of Spreads having multiple expiries is highly dependent on the last traded price of the underlying asset. Right now, BankNIFTY’s LTP is 19913.6.

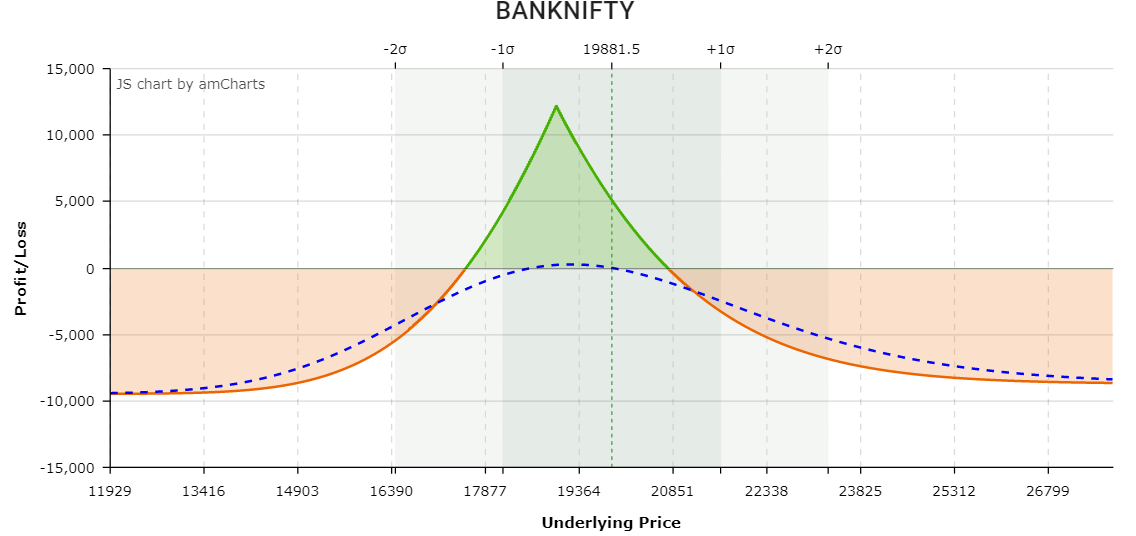

Let’s construct a Long Put Calendar Spread like we did for call spread. Here is an example of a payoff graph where –

- Sell BankNIFTY 16th Apr 19000PE at 471.5

- Buy BankNIFTY 30th Apr 19000PE at 907.15

Directional Assumption: Neutral

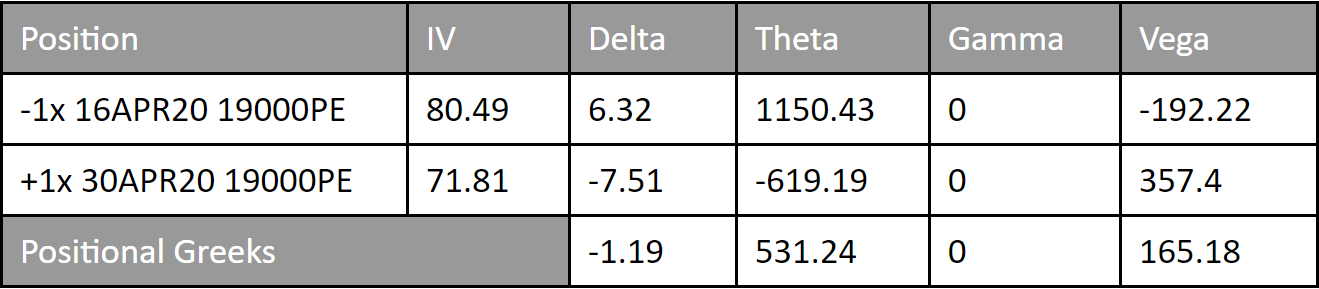

Let’s have a look at the greeks for better understanding –

We can say it is delta neutral as delta is almost 0.

since puts have higher IV; long CE calendar spread would be better than PE spread ?

PE is better because as You’re buying the monthly. You don’t want that to get reduced. Do you? 🙂