Long Butterfly Spreads

Short term volatility is greatest at turning points and diminishes as a trend becomes established. By the time all the participants have adjusted, the rules of the game will change again.

-George Soros

What about a neutral position that’s used when a trader believes that the price of an underlying asset is going to stay within a relatively tight range.

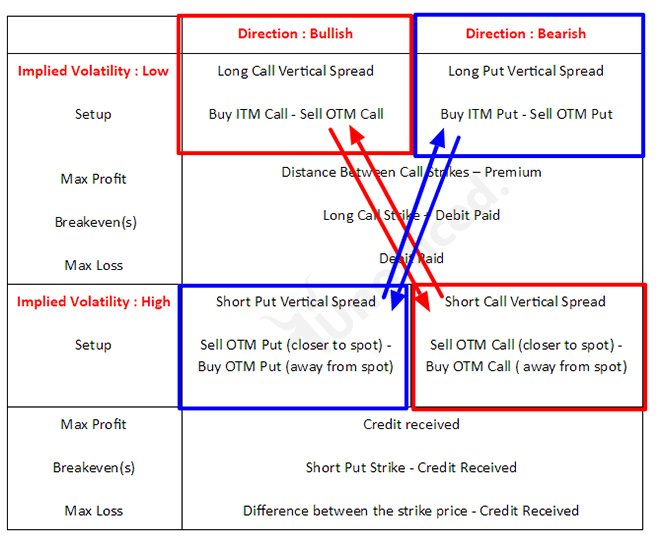

Let’s recall our vertical spreads. We see four strategies with this following properties –

- ‘Bullish direction; Low IV’

- ‘Bullish direction; High IV’

- ‘Bearish direction; Low IV’

- ‘Bearish direction; High IV’.

Now, What if we cross the strategies?

Like combining ‘bullish direction; low IV’ with ‘bearish direction; high IV’ as shown above. That will create two neutral strategies.

Combining –

- ‘Bullish direction; Low IV’ with ‘Bearish direction; High IV’.

- ‘Bullish direction; High IV’ with ‘Bearish direction; Low IV’

Creates a Long Butterfly Spread!

We get neutrality in direction as well as some amount of neutrality in IV.

Directional Assumption: Neutral

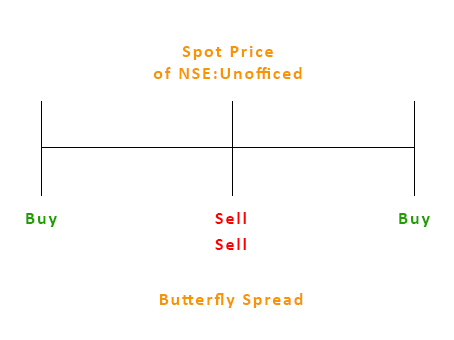

Setup: This spread is typically created using a ratio of 1-2-1 (1 ITM option, 2 ATM/near ATM options, 1 OTM option).

- Buy Call/Put (above short strike)

- Sell 2 Calls/Puts

- Buy Call/Put (below short strike)

A butterfly will be delta neutral by construction. A long butterfly[1] will act like a short straddle while a short butterfly will act like a long straddle!

But, unlike straddles – It has limited loss on both sides as well as there is no mix up of call options and put options. Either it will be constructed with all put options or call options!

But this is a low probability trade as it is generally awkward to assume that price will stick to one same price! So, the Market compensates us for taking this approach.

If a long butterfly has reduced risk when the trader is wrong, it will also have increased profit when the trader is right. As there is a very tight range of profit – the probability of that profit is very low!

Ideal Implied Volatility Environment: High[2]

This following image will help in visualization –

How to Calculate Breakeven(s):

- Upside: Higher Long Option Strike – Debit Paid

- Downside: Lower Long Option Strike + Debit Paid

In other words, The butterfly will fly worthless if the spot goes above or below the outside strike prices.

Also, it is almost delta neutral as we are choosing ATM strike prices to sell and equidistant strike prices to buy.

The current NIFTY Spot price is 9857.05. Our assumptive ATM call is hence 9850 CE and 9850 PE. Let’s take 100 points on both sides for constructing Butterfly’s wings.