Implied Volatility Rank

IV Rank is a measurement of current IV from 0 to 100 range based on the historical implied volatility range (High IV – Low IV) of that instrument on a certain timeframe. We usually look at a time frame of one year.

It is impossible to take note of all historical IV and keep doing calculations to compare it with the current IV. IVR does the job.

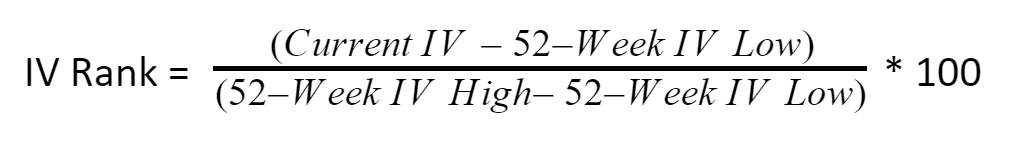

Calculations:

IV Rank is calculated using the formula.

Let’s say the IV range is 30-60 over the past year. Thus the lowest IV value is 30, and the highest IV value is 60. We need to compare the current IV value to this range to understand how the current IV ranks in relation to its historical IV range.

If the current IV value is 45, then this would equate to an IV Rank of 50% since it falls in the middle of this range.

Usage:

When IV Rank approaches a value of greater than 50, then option sellers can use this to their advantage to take in rich options premium with the expectation that this implied volatility will decrease.

- Comparing one stock’s implied volatility to another isn’t apples-to-apples.

- Comparing one stock’s implied volatility rank to another is an apples-to-apples comparison!

Drawbacks:

One of the drawbacks of IV Rank is that it doesn’t take extreme IV spikes into account. If there is any fundamental event like corporate earnings, it can shoot IV to 300% for a few hours. But, IV rank will be stuck at 100 because of our choice of range.

Also, because of this same reason – When IV falls after a massive surge in implied volatility, IV rank readings will be low even when the implied volatility of the stock is still relatively high.

IV Rank doesn’t tell the whole story. IV Percentile takes care of this flaw.