Extrinsic & Intrinsic Value

Option Price = Intrinsic value + Extrinsic value

Extrinsic value is time & volatility value.

This is affected by time until expiration and implied volatility. All options have some level of extrinsic value as long as there is time left until the expiration of the option.

Intrinsic value is the real value at expiration.

If the strike allows the option owner to buy shares at a discount (calls), or sell shares at a higher price than the market (puts), the option will have intrinsic value and be considered to be in the money. Calls that are below the stock price have intrinsic value. Puts that are above the stock price have intrinsic value.

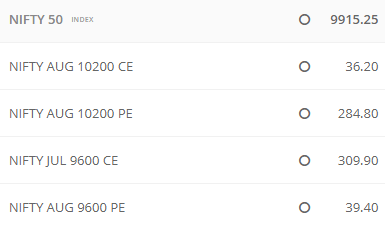

In the above image,

- Intrinsic value of 10200 CE is 0.

- Intrinsic value of 10200 PE is 10200 – 9915.25 = 284.75

- Intrinsic value of 9600 CE is 9915.25 – 9600 = 315.25.

- Intrinsic value of 9600 PE is 0

For OTM options, there is no intrinsic value. Extrinsic Value always becomes zero at the expiration.