Options Premium Calculator using Black Scholes Model: Google Sheet

Inputs in Black-Scholes Option Pricing Model Formula

- S0 = underlying price

- X = strike price

- σ = volatility

- r = continuously compounded risk-free interest rate

- q = continuously compounded dividend yield

- t = time to expiration

For,

- σ = Volatility = India VIX has been taken.

- r = 10% (As per NSE Website, it is fixed.)

- q = 0.00% (Assumed No Dividend)

Note: In many resources, you can find different symbols for some of these parameters.

For example,

- The strike price is often denoted

K(here it isX). - Underlying price is often denoted

S(without the zero) - Time to expiration is often denoted

T – t(difference between expiration and now).

In the original Black and Scholes paper (The Pricing of Options and Corporate Liabilities, 1973) the parameters were denoted x (underlying price), c (strike price), v (volatility), r (interest rate), and t* – t (time to expiration).

The dividend yield was only added by Merton in Theory of Rational Option Pricing, 1973.

Call and Put Option Price Formulas

Call option C and put option P prices are calculated using the following formulas:

![]()

![]()

where N(x) is the standard normal cumulative distribution function.

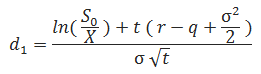

The formulas for d1 and d2 are:

![]()

Original Black-Scholes vs. Merton’s Formulas

In the original Black-Scholes model, which doesn’t account for dividends, the equations are the same as above except:

- There is just

S0in place ofS0 e-qt - There is no

qin the formula ford1

Therefore, if the dividend yield is zero, then e-qt = 1 and the models are identical.

Black-Scholes Formulas for Option Greeks

Delta

![]()

![]()

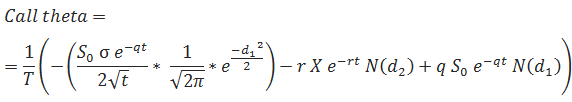

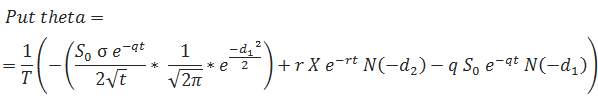

Theta

… where T is the number of days per year (calendar or trading days, depending on what you are using).

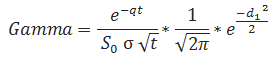

Gamma

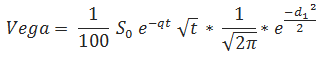

Vega

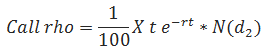

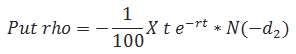

Rho

Excel/Google Sheet Formulas for Calculation of Black Scholes Model

- Underlying Price:

B1 - ATM Strike Price:

B2 - Today’s Date:

B3 - Expiry Date:

B4 - Historical Volatility:

B5 - Risk-Free Rate:

B6 - Dividend Yield:

B7 - DTE (Years):

B8

d1, d2 Calculation

- d1 =

(LN(B1/B2)+(B6-B7+0.5*B5^2)*B8)/(B5*SQRT(B8)) - Nd1 =

EXP(-(B10^2)/2)/SQRT(2*PI()) - d2 =

B10-B5*SQRT(B8) - Nd2 =

NORMSDIST(B12)

Calculation Of Greeks

If You see the above formulas, these are derived directly from those formulas –

- Call Theta =

(-((B1*B5*EXP(-B7*B8))/(2*SQRT(B8))*(1/(SQRT(2*PI())))*EXP(-(B10*B10)/2))-(B6*B2*EXP(-B6*B8)*NORMSDIST(B12))+(B7*EXP(-B7*B8)*B1*NORMSDIST(B10)))/365 - Put Theta =

(-((B1*B5*EXP(-B7*B8))/(2*SQRT(B8))*(1/(SQRT(2*PI())))*EXP(-(B10*B10)/2))+(B6*B2*EXP(-B6*B8)*NORMSDIST(-B12))-(B7*EXP(-B7*B8)*B1*NORMSDIST(-B10)))/365 - Call Premium =

EXP(-B7*B8)*B1*NORMSDIST(B10)-B2*EXP(-B6*B8)*NORMSDIST(B10-B5*SQRT(B8)) - Put Premium =

B2*EXP(-B6*B8)*NORMSDIST(-B12)-EXP(-B7*B8)*B1*NORMSDIST(-B10) - Call Delta =

EXP(-B7*B8)*NORMSDIST(B10) - Put Delta =

EXP(-B7*B8)*(NORMSDIST(B10)-1) - Gamma =

(EXP(-B6*B8)/(B1*B5*SQRT(B8)))*(1/(SQRT(2*PI())))*EXP(-(B10*B10)/2) - Vega =

(EXP(-B6*B8)/(B1*B5*SQRT(B8)))*(1/(SQRT(2*PI())))*EXP(-(B10*B10)/2) - Call Rho =

(1/100)*B2*B8*EXP(-B6*B8)*NORMSDIST(B12) - Put Rho =

(-1/100)*B2*B8*EXP(-B6*B8)*NORMSDIST(-B12)