This report of D-Mart IPO is also a good example of Value Investors for researching companies!

Avenue Supermarts (or, D-Mart) seems to have developed a competitive advantage over its peers owing to its different strategy. The company is doing two essential things differently – owning rather than renting retail stores and selling things cheaper than its peers.

I don’t know how the former gives it any advantage over others because the company has to take debt(and block capital) to buy the stores which lead to a fixed interest cost that is almost similar to rental costs which it supposedly saves. But the latter does provide it a strong competitive advantage.

When you sell your products cheaper than your competitors, you attract a larger number of customers to your store. So even though you make a lower gross profit margin compared to your peer, you’re able to sell a larger volume of products than the peer, resulting in much higher sales per store and higher gross profits despite the lower margins. And you get the advantage of operating leverage -higher gross profit gets distributed over marginally higher operating expenses(since most of the expenses are of fixed nature) – resulting in higher EBITDA margins. (If you study carefully, you will see that Future Retail too has started lowering its gross margins. So let’s see the sustainability of this strategy.)

The other advantage of this strategy is that since you sell your products rapidly, your suppliers are happy with you and they give you discounts.

Key risks

Price disruption is mentioned as a key risk to the business:

If we are unable to continue to offer daily low prices pursuant to our EDLC/EDLP pricing strategy, we risk losing our distinct advantage and a substantial portion of our customers which will adversely affect our business, financial condition and results of operations. Further, in case of shortages, our suppliers may increase prices of products beyond our control due to which we may lose our competitive advantage.

Several of our competitors including e-tailers offer promotional prices on select products at a given time period or around festivals, holidays or weekends. We have not followed this model in the past and do not intend to follow it in the future. While we have managed to grow our customer base in the past, there can be no assurance that our target customer base will not develop a preference for the promotion model and be attracted to promotional deals offered by our competitors.

Further, in relation to General Merchandise & Apparel products, we do not have fixed terms of trade with the majority of our distributors or suppliers. Accordingly, we may not have access to additional discounts and special schemes offered by such distributors and suppliers, which may make it difficult for us to always follow the EDLC/EDLP strategy.

The second pertinent risk in this business is that as they grow rapidly it will obviously become difficult for them to find suitable locations for new stores. Though they have successfully demonstrated their capability in showing profitable growth in the past.

As we expand our store network, we will be exposed to various challenges, including those relating to identification of potential markets and suitable locations for our new stores, obtaining land or leases for such stores, competition, different cultures and customer preferences, regulatory regimes, business practices and customs.

As a new store location should satisfy various parameters to make an attractive commercial proposition, finalisation of location and property acquisition for our new stores is an evolving process which may not progress at the same pace as in the past or at the expected pace. Further, the ownership model requires greater capital for opening of each store due to which we may not be able to expand at our historical rates. We may be required to obtain loans to finance such expansion and there can be no assurance that such loans will be available to us on commercially acceptable terms, or at all.

The company generates a big portion of its revenue from the Foods category including staples.

Revenue generated from the sale of our Foods product category including staples groceries, fruits and vegetables, snacks and processed foods, dairy and frozen products, beverages and confectionery constituted 53.06% of the Revenue from Sales of our Company for the year ended March 31, 2016.

We believe that we have been successful in this category due to our deep knowledge of product assortment, pricing dynamics and strong supplier relationships. Our success in this category is also, in part, dependent on our ability to offer value for money using EDLC/EDLP pricing strategy. If our competitors are able to successfully follow our EDLC/EDLP pricing strategy or due to a change in customer preferences or any other factors, whether within or beyond our control, our revenue and profitability from this category may decrease and this may result in an adverse effect on the financial condition of our Company.

The company’s promoters own interest in other retail businesses of different formats.

Our Promoters directly own 50.75% in our Associate Company, Avenue E-Commerce Limited. Although our Associate Company has not yet commenced operations, its objects include e-tailing of products. We cannot assure you that the operations of our Associate Company will not be in the same markets as which we currently operate in and its offerings will not compete with us. Furthermore, some of our Promoters and members of Promoter Group own interests in other retail businesses (of different formats) such as Bombay Swadeshi Stores Limited.

There can be no assurance that our Promoters will not conduct or engage in competing businesses in the future. Further, there is no requirement or undertaking for our Promoters or Associate Company or such similar entities to conduct or direct any opportunities relating to the retail industry only to or through us. As a result, conflicts of interests may arise in allocating business opportunities amongst our Company and our Associate Company in circumstances where our respective interests diverge. In cases of conflict, our Promoters may favour our Associate Company or other companies in which our Promoters have interests in the future.

There can be no assurance that our Promoters or our Group Companies or members of the Promoter Group will not compete with our existing business or any future business that we may undertake or that their interests will not conflict with ours.

Further, our Company has entered into leave and license arrangements with 7 Apple Hotels Private Limited, Promoter Group entity of our Company. For further details, see “Our Promoters and Promoter Group” on page 154. We may continue to enter into arrangements with entities where our Promoters are interested and there can be no assurance that our Promoters will not have conflict of interest in such cases.

Overview of the business

According to Technopak, in Fiscal 2016 the Company was one of the largest and the most profitable F&G retailer in India. The company offers a wide range of products with a strong focus on the Foods, Non-Foods (FMCG) and General Merchandise & Apparel product categories.

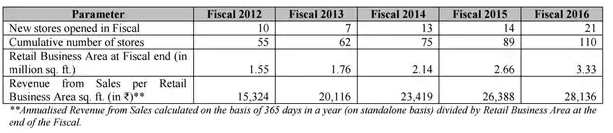

From just one store in Mumbai in 2002 the company has grown to 112 stores as on 15th September 2016 located across 41 cities with a main focus on Maharashtra(58) and Gujarat(26) followed by Telangana (13), Karnataka (7), Andhra Pradesh (3), Madhya Pradesh (3), Chhattisgarh (1) and NCR (1). The total business area of all the stores is about 3.40 million square feet.

At the end of Fiscals 2014, 2015 and 2016, we had 75, 89 and 110 stores with Retail Business Area of 2.14 million sq. ft., 2.66 million sq. ft. and 3.33 million sq. ft., respectively. We plan to deepen our store network in southern and western India and gradually expand our network in other parts of India pursuant to our cluster-focused expansion strategy.

For Fiscal 2016, Maharashtra contributed a majority of Revenue from Sales (62.57%) followed by Gujarat (18.83%), Telangana (10.15%), Karnataka (6.14%) Andhra Pradesh (1.03%), Madhya Pradesh (0.85%) and Chattisgarh (0.43%).

So we can see that a majority of the company’s revenue is coming from Maharashtra and Gujarat.

The company mostly operates on an ownership model (including long-term lease arrangements, where lease period is more than 30 years and the building is owned by the company) rather than a rental model.

The company follows cluster approach while opening new stores on the basis of adjacency and focusing on an efficient supply chain, targeting densely-populated residential areas with a majority of lower middle, middle and aspiring upper-middle class consumers.

The company operates distribution centers and packing centers which form a backbone of its supply chain. As on 15th September 2016, it has 21 distribution centers and 6 packing centers located mainly in Maharastra, Gujarat, Telangana and Karnataka.

The total revenue grew at a Compounded Annual Growth Rate (CAGR) of 35.28% from Rs 47,023.25 million in Fiscal 2014 to Rs 86,061.05 million in Fiscal 2016. The net profit after tax grew at a CAGR of 41.08% from Rs 1,613.72 million in Fiscal 2014 to Rs 3,212.07 million in Fiscal 2016.

Business strategy

Instead of focusing on discretionary spending, the company distinguishes its business by focusing on selling necessary and basic products. The company minimises its operating costs in several ways such as owning underlying real estate or entering into long-term lease arrangements for a majority of its stores in order to minimise rental costs, procuring goods directly from vendors and manufacturers, employing an efficient logistics and distribution system and maintaining a strong focus on product assortment to minimise inventory build-up, supported by efficient store operations.

Some of the key strengths of the company according to the DRHP:

Value retailing to a well-defined target consumer base

Our business model is based on the concept of offering value retailing to our customers using the EDLC/EDLP strategy. The EDLC/EDLP strategy is based on offering low prices on an everyday basis by achieving low procurement and operations cost rather than as special promotion limited to certain products or to a particular day, week or any other specific period in the year.

Our customer acquisition and retention strategy is targeted at lower-middle, middle and aspiring upper-middle income consumers. We believe that getting value for money is the most compelling factor in daily shopping decision-making for these income groups. The majority of the products stocked by us are essential products forming part of basic rather than discretionary spending, due to which we believe that our business is not materially affected by seasonality or temporarily depressed macro-economic conditions.

The EDLC/EDLP strategy requires us to minimise our costs of procurement, supply and operation to achieve low prices for our customers on a daily basis. We focus on providing such low prices across our product categories and product subcategories within these categories everyday rather than on a particular day of the week or any specific period of the year.

We typically follow our pricing strategy for all our products, relying on our strong supplier network, efficient supply chain management for procurement and careful product assortment. We believe that these measures help us in being recognised as a one-stop retail store chain for daily needs at value for money prices.

Steady footprint expansion using a distinct store acquisition strategy and ownership model

Key highlights of expansion during the last five years:

We have expanded our footprint using a cluster-based approach. We have strengthened our existing presence in certain regions by opening new stores within a radius of a few kilometers of our existing stores and distribution centres. This has ensured the creation of a cluster of stores within a region in which we believe, we have developed a better understanding of local needs and preferences and enabled us to tailor our offering. Such clusters have also led to increased penetration and presence in under-served markets, higher cost efficiency due to economies of scale achieved in our supply chain and inventory management, and greater and concentrated brand visibility due to focused implementation of marketing and advertising initiatives.

In the process of opening new stores, we take various factors into account, including population density, customer traffic and vehicular traffic, customer accessibility, potential growth of the local population and economy, area development potential and future development trends, estimated spending power of the population and local economy and payback period, estimated on the basis of expected sales potential, strategic benefits, proximity and performance of competitors and store site characteristics. We have largely kept the layout and design of our stores consistent and predictable to make shopping with us easier.

According to the company, ownership of stores has provided it a strong competitive advantage by lowering its operational costs.

We have posted consistent growth in our ROE despite owning the real estate underlying several of our stores. We believe that owning the real estate on which our stores are built or entering into long-term lease arrangements has helped us control our fixed costs per store. Other than the rental savings, which is partially offset by higher capital and capital servicing costs, we believe that ownership (including long-term leases) of our stores provides us with significant long-term competitive advantage.

Deep knowledge and understanding of optimal product assortment and strong supplier network enabling procurement at predictable and competitive pricing, leading to an overall efficient cycle.

High operating efficiency and lean cost structures through stringent inventory management using IT systems

We have benefited from our in-depth understanding of local needs and our ability to respond quickly to changing consumer preferences. This has been achieved in part due to our advanced IT systems. We use our IT systems for procurement, sales and inventory management which enables us to identify and quickly react to changes in customer preferences by adjusting our products available, brands carried, stock levels and pricing in each of our stores and effectively monitor and manage the performance of each of our stores.

Together with our supply chain management systems and our internal controls to minimise product shortage and the occurrence of out-of-stock situations and pilferage, we are able to operate efficiently and productively with minimal disruptions to our day to day operations. Our Inventory Turnover Ratio (computed by dividing revenue from operations by average inventory, which is an average of opening inventory and closing inventory) was 14.32, 14.03 and 14.18, respectively in Fiscal 2014, 2015 and 2016.

The company has a strong management team.

Strong promoter background and an experienced and entrepreneurial management team with a proven track record and a high degree of employee ownership.

The company’s founder, Radhakishan Damani is a well-known investor in the Indian stock market. A value investor knows how to run a business efficiently.

Our Board and senior management have a proven track record and an in-depth understanding of the retail business in India and local consumer preferences. Key members of our senior management team including Ignatius Navil Noronha, our Managing Director (who has over 18 years of experience in the FMCG sector) and Ramakant Baheti, our Chief Financial Officer and an Executive Director on our Board (who has over 19 years of experience in the finance function) are dedicated to the sustainable growth of our business and have been with us for several years. We believe that our stable, senior management team has helped us successfully implement our development and operating strategies and provide quality service to our customers over the years.

We also believe that our employees have been an important factor in our success as the quality and efficiency of the services we provide are dependent on them. We have followed transparent management policies and have implemented employee stock option schemes over the years. Many of our present and past employees hold Equity Shares in our Company.We believe in continuous development and have invested in our employees through regular training programmes to improve skills and service standards, enhance loyalty, reduce attrition rates and increase productivity.

Future strategies

The company plans to continue expanding its stores in existing as well as new clusters. Maharastra and Gujarat will remain the key areas for store expansion. The company also intends to strengthen its store network in Andhra Pradesh, Telangana, Madhya Pradesh, Karnataka, Chhattisgarh, Tamil Nadu and northern India.

The company has opened a new store in Ghaziabad, NCR in June 2016. The company will slowly develop clusters in new areas.

The key factor affecting the expansion of our stores is the selection of suitable locations. We will continue to adopt a methodical and approach in evaluating and selecting suitable locations for the establishment of new stores, such as local population density, accessibility and proximity to our competitors.

In order to optimise our profitability, maintain our operational flexibility and ensure that our stores continue to be located in densely populated neighbourhoods and residential locations, we intend to continue our flexible strategy of owning or leasing our premises according to availability, cost and other considerations.

We believe that owning the real estate for majority of our stores helps us control our fixed costs per store and helps us execute our EDLC/EDLP strategy effectively and we will continue to follow this strategy. We will continue to strive to improve our Fixed Asset Turnover Ratio (computed by dividing revenue from operations by total fixed assets) which was 3.72, 3.96 and 3.95 for Fiscal 2014, 2015 and 2016, respectively.

Financial Analysis

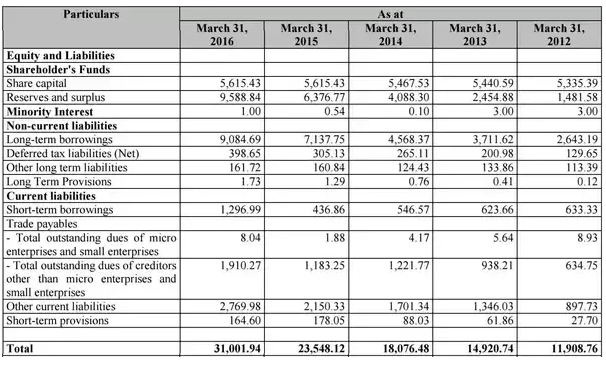

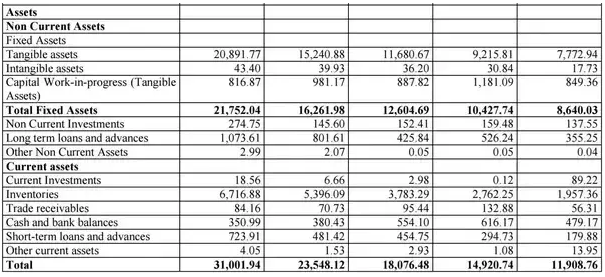

Balance Sheet

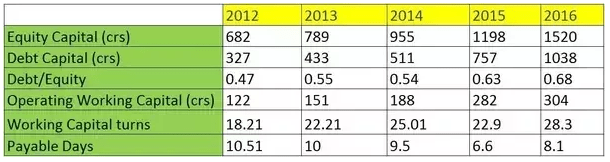

The growth in debt is a bit faster than equity resulting in a rising debt/equity ratio. In one of my earlier answers I have shown that if a company is able to generate an ROCE which is significantly higher than the interest cost on its borrowings, then it makes sense to take more debt. This is what Avenue Supermarts has been doing and it’s not a bad thing since the company is running its operations very efficiently.

Working Capital turns have slowly risen from 18.21 times to 28.3 times indicating that the company is using its working capital very efficiently; higher working capital turns means that lower working capital will be required to generate a unit revenue, resulting in higher cash flows.

The company has maintained Payable days at very low levels of less than 10 days. In contrast, its listed competitors maintain payable days between 40–50 days. It means that the company pays its vendors/suppliers on time and they, in return, give discounts to the company.

The company has increased its fixed assets at 26% CAGR over the last five years.

Income Statement

The company has reported a strong financial growth over the last five years with revenue growing at a CAGR of 40% and EBITDA growth of 45% CAGR.

The company has low-cost debt on its balance sheet; it’s paying less than 9.5% interest on its total debt.

I’ve calculated EPS on the basis of post-issue equity capital.

Same store sales(average) is the average sales of all the stores – old and new.

Like For Like growth measures the growth of revenue from stores that have been operational for at least 24 months. As you can see, there is a gradual decline in LFL growth as you can’t grow same-store sales indefinitely – older stores will gradually achieve saturation, therefore a continuous expansion of stores is necessary to drive growth.

Same-store sales growth is the most valuable source of revenue growth as it doesn’t require additional investment in fixed assets.

Revenue per sq.ft. is growing at around 10.25% but total revenue is growing at more than 35%. This implies that the company is increasing its total store area to drive revenue growth.

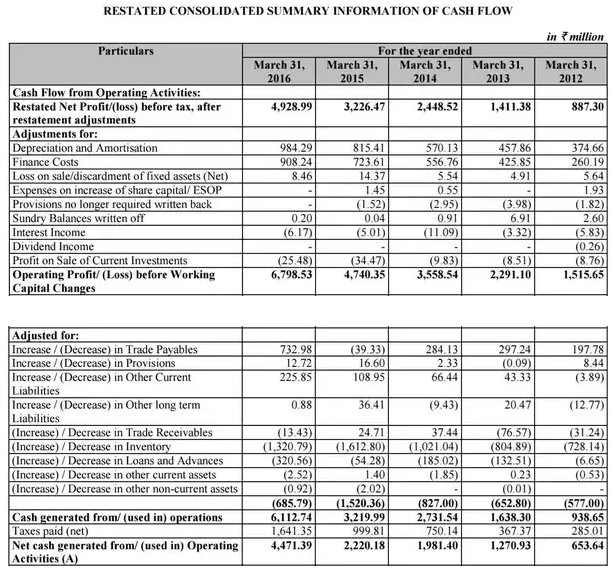

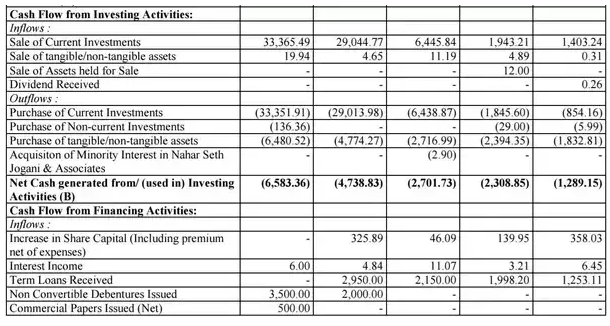

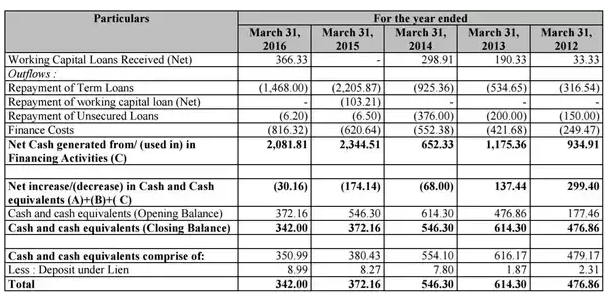

Cash Flow Statement

CFO excluding finance cost would be Rs 356 crore for FY 16 and Rs 150 crore for FY 15.

The company is spending a larger amount than CFO on “Purchase of tangible and non-tangible assets”. This caps on fixed assets was Rs 658 crore for FY 16 and Rs 477 crore for FY 15. Almost half of this CapEx is funded by debt – the company issued NCDs worth 350 crore and commercial papers worth 50 crores in FY 16.

The company is not paying a dividend. This is not a negative thing as reinvestment of funds has created more value owing to high ROCE/ROE levels. The company should continue the trend of not paying dividends.

D-Mart IPO Valuation

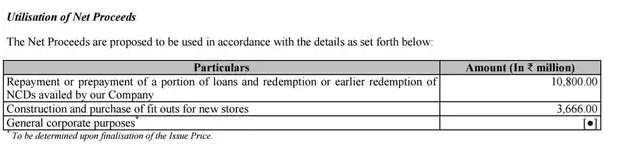

D-Mart IPO consists of a fresh issue of Rs 1870 crore. There is no offer for sale by existing shareholders.

Price band: RS 295–299 per share

So the company will issue approximately 6.25 crore fresh shares at the upper band.

- Outstanding shares before the issue = 56.15 crore

- Outstanding shares after the issue = 62.4 crore

- Market cap post issue = Rs 18657 crore

We don’t know the company’s financial performance for any quarter of FY 17. I’m assuming a growth of 30% in revenue and 35% in EBITDA for FY 17. The net profit would probably grow by 45% during FY 17.

For FY-18 let’s assume revenue growth of 25%, EBITDA growth of 30% and net profit growth of about 50% as finance cost would have gone down as debt would also be reduced.

The company is being valued at an FY-17 P/E of 40.13 and an FY-18 P/E of 26.67.

The valuation on EV/EBITDA basis (assuming 200–300 crore debt post issue) is 20.37 times for FY-17 and 16 times for FY-18.

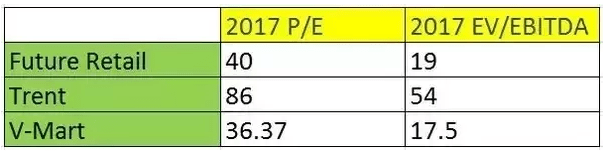

Valuation of competitors:

Keep in mind that all of these companies are growing at much slower pace and have lower EBITDA margins and return ratios compared to Avenue Supermarts.

Demonetisation has helped retail companies grow at a faster than normal pace in the third quarter for the current FY as most of the customers preferred cashless transactions during this period.

Conclusion

The company has an excellent track record with good future prospects. It will be the only listed retail company clocking an ROCE greater than 20%.

“Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.” – Warren Buffett

Avenue has been employing large amounts of incremental capital at high ROCE. I think it can continue this profitable employment of capital for the next 5 years as well.

So if you’re a long-term investor, you can apply for this D-Mart IPO.